Southeast Michigan Housing Report April 2022 - Pricing Competing Offers

- Mitchell Peterek

- May 6, 2022

- 3 min read

Southeast Michigan Housing Report April 2022

Real Estate One Research Department

Pricing Competing Offers

The market continues to run hot with inventory shortages and the best new listings selling within hours for well over asking price. Many of our clients have lost out on previous bidding wars. When we see a gorgeous new listing that’s sure to create a feeding frenzy, how can we write offers that will likely be accepted?

1. Listing to Pending Ratio:

Look at the ratio of available active comps to pending/under contract (UC) properties. In a balanced market there are about three active listings for every UC. Two-to-one is a fast market, and one-to-one means there’s only 30 to 45 days of inventory. We’re seeing extreme ratios of 1:2, 1:3 and sometimes even 1:5— where there are 5 UCs for every available active listing. Look at comparables to ensure we understand current market balance.

2. Level of Excitement:

If we’re are excited about the listing and perceive it as a great “value” compared to the other similarly price properties, other buyers are too. Ask yourselves, “If we make an offer but don’t get it, what are the chances we’ll find something that we like more within this price range?” Also, “If we don’t get this, how much more would you likely have to pay to get something we like as much?”

3. Consider the Difference Between Sale Price and List Price with Comps:

Pull the most recent 10 or 20 sold comps. With a spreadsheet or notepad create a list that includes list price, sold price and price per square foot (see example on next page). Add a column where you can calculate the difference between list price and sold price. This spreadsheet will help us see both how many similar listings are selling at or over list price and more importantly, how much they are selling over asking price. Note that we’ll be looking at all comparably priced properties—the more extraordinary our subject property is, the more it moves toward the higher end of the range of previous over-asking-price offers.

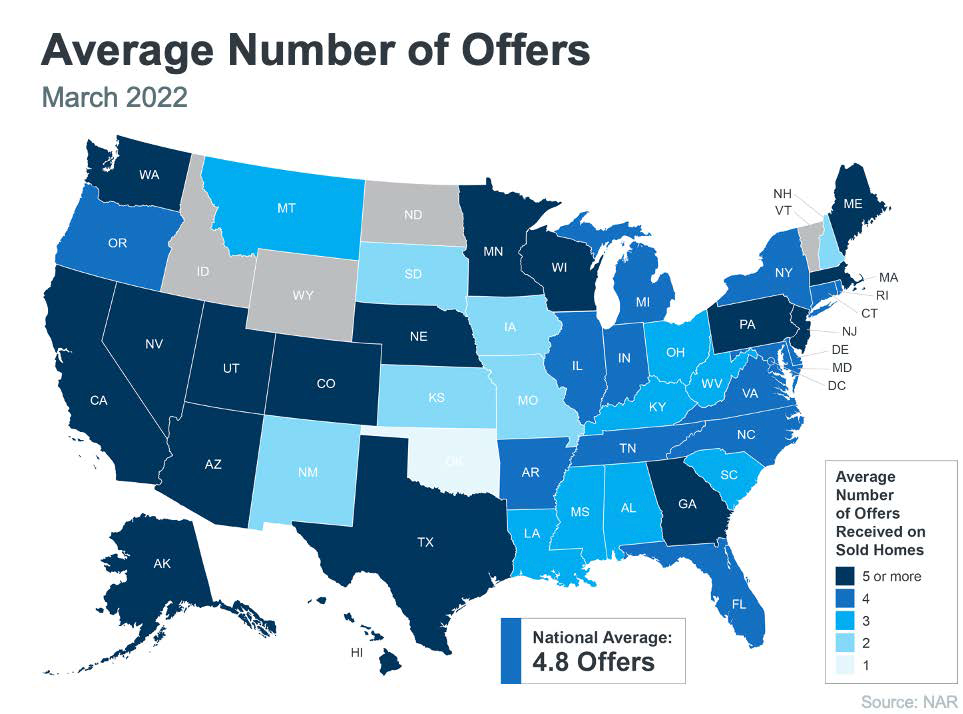

*Michigan sits right around the national average.

Example Scenario

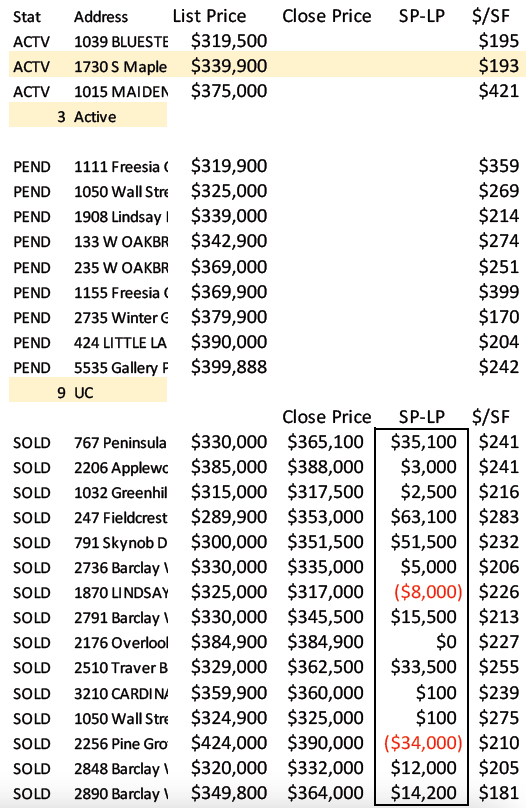

Our client wants to make an offer on 1730 S Maple.

1. There’s only 3 active comps and 9 UCs— 1:3 ratio is extremely hot market. When everything is selling put more weight on active and uc list prices and $/SF. Note the $199/sf is low compared to other listings, pendings and sold comps.

2. If we perceive this is better than most comps, the listing may be under-priced. We need to figure out, with our agent and lender, how much over asking we can and should go.

3. Looking at the difference between the sale prices and list prices for Sold Comps. Thirteen of last 15 closings have sold at or over asking—only 2 didn’t. Over-asking amounts range from $0 to $63k. The median is $12k over. Being aware of what others have “paid-over-asking” will help us strategize in calculating our offer amount. Be sure to ask your agent about additional tools like appraisal gap guarantees, occupancy, etc. we can use to enhance our offer.

While demand remains intense, the lack of quality inventory has restricted first quarter sales activity. As additional fresh listings arrive, sales are rising. Although first quarter closed sales were down 6% compared to last year, last month’s new pendings were up 26% from the prior month and 20% compared to the same month last year. Buyers are scrambling to lock in their new homes before rising interest rates, prices and taxes further undermine affordability. Expect strong buyer competition and bidding wars to drive up prices and reduce market times through the first half of the year as buyers compete for the prime listings as quickly as they arrive. As it did last year, the market will settle in the second half as inventories contain fewer available top-quality listings.

Comments